CIBIL, Credit Information Bureau India LTD, is an Indian credit agency that generates your credit report containing all your credit information. It is RBI authorised institution and is the most trusted company that holds everyone’s credit information. Your CIBIL score, which is presented in your CIBIL report, is also generated by this bureau.

CIBIL Score and Its Importance

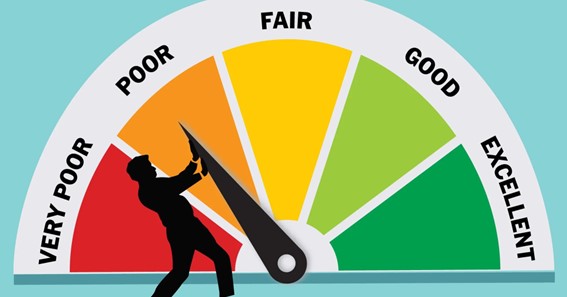

The CIBIL score is a rating that ranges between 300 to 900, with 300 as the lowest and 900 as the highest score. Banks and financial institutions use this score to check your creditworthiness when applying for a personal loan or credit product.

A CIBIL score is important because a lender will make their decision of lending you debt based on a good CIBIL score. Several factors make up a CIBIL report:

- Timely repayments of debts

- Staying within the credit utilisation limit

- Number of loan applications at one time

- Credit mix

- The length of your credit history

- Outstanding debt in total

Understanding the CIBIL Score Ranges

The CIBIL score consists of various ratings between 300 to 900. Here’s a table that gives an in-depth of what every range means and how the lender views you:

| Credit Score | Credit Worthiness | What It Means |

| NA/NH | Not Available or No History | If you haven’t ever used a credit card or taken a loan before, you don’t have a previous credit history. |

| 300-549 | Poor | Multiple missed or late loan EMIs or credit card repayments, increased credit enquiries, or exceeded the credit utilisation limit. Lenders may not approve your application with this score. |

| 550-649 | Fair | May have missed some repayments or had multiple card enquiries. Lenders may still not approve. However, they’ll charge higher interest rates and down payments if they accept your application. |

| 650-749 | Good | A good repayment history and a lower risk of getting rejected. But lenders won’t give the best interest rates yet. |

| 750-799 | Very Good | A long and regular credit history with proper repayment. You’re a low risk to the lenders, so you’ll get approvals and great deals. |

| 800-900 | Excellent | You have a great credit history, regular repayments, and low credit utilisation. You’ll get the best deals on credit cards, favourable terms, and interest rates. |

What’s a Good CIBIL Score?

A CIBIL score is considered good when it exceeds 700-750. But, remember that every lender has its own method of considering risk grades. For example, if one bank recognises 700 as low risks, another bank doesn’t need to consider the same grade.

What’s a Bad CIBIL Score?

Anything below 600 is considered a bad CIBIL score. No lender will trust to give you money if you don’t make timely repayments or hold a high credit utilisation limit. You will have a hard time getting a loan, and even if you get one, you’ll have high interest rates and no flexibility in choosing repayment tenure.

However, nothing is unfixable. If you have a low CIBIL score, there is no need to worry; it’s not going to stay the same if you try to improve your cibil score. This will happen once you keep a check on your report and analyse which financial habit of yours is keeping you away from having a good CIBIL score.

The Importance of a Good CIBIL Score

The better your score, the more a lender can trust their money with you. They weigh your repayment capacity with your CIBIL score, so if you possess a score higher than 700, you’ve better chances of returning their debt timely.

Apart from approvals, maintaining a good score is also important for:

- Faster loan application process

- Lesser interest rate on personal loans and business loans

- Access to a higher loan amount

- Wide choices in repayment tenure

- Multiple choice in selecting lenders

Hence, you benefit a lot when you maintain a good CIBIL score.

Conclusion

Now that you know the difference between a good and bad CIBIL score and why CIBIL score range is important, make responsible financial decisions that won’t decrease your score. Make timely repayments and regularly check your score so that you have a track of what direction you’re heading into.

Author Bio:

Shiv Nanda is a financial analyst who currently lives in Bangalore (refusing to acknowledge the name change) and works with MoneyTap, India’s first app-based credit-line. Shiv is a true finance geek, and his friends love that. They always rely on him for advice on their investment choices, budgeting skills, and personal financial matters and when they want to get a loan. He has made it his life’s mission to help and educate people on various financial topics, so email him your questions at [email protected].